The mortgage payoff calculator makes the life of the borrower easy as it provides a very fast computation of the EMI (Equated Monthly Installment) for a loan period of up to 30 years. The mortgage loan calculator summarizes the result and also provides you with a detailed monthly calculation. Another important aspect of this mortgage payoff calculator is that it also computes the savings you can have for extra payments you make daily, weekly, quarterly, monthly or yearly.

What is a mortage loan?

A mortgage or “mortgage loans” is a type of loan you can use to buy or refinance a home. So, there are two parties involved in every mortgage transaction – a lender and a borrower. A lender is a financial institution that loans you money to buy a home. Your lender might be a bank or credit union, or it might be an online mortgage company. Test our home mortgage qualification calculator as well.

Mortgage PayOff Calculator

Difference between loan and mortgage

Both are loans or debts, but there are a few basic difference as mentioned below :

- All mortgages are loans, but not all loans are mortgage.

- A mortgage is a secured loan because it is backed by the property for which the money is being lent. A loan may be secured or unsecured. In the case of a mortgage, the collateral is the home

Use Excel to Calculate Monthly Mortgage Payment

To figure out how much you must pay on the mortgage each month, use the following formula in excel or Google spreadsheet.:

= -PMT(Interest Rate/Payments per Year,Total Number of Payments,Loan Amount,0)

The PMT function calculates the required payment for an annuity based on fixed periodic payments and a constant interest rate.

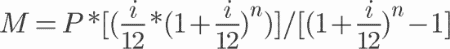

The formula for Computing Payments Manually

If you want to compute mortgage payments manually, no problem. Just figure out your monthly mortgage payment (“M”), input the principal (“P”), monthly interest rate (“i”), and a number of months (“n”) from your loan in the following formula for our mortgage calculations:

To determine the monthly rate, divide the annual amount by 12. So, if your rate is 6%, the monthly rate would be 0.06/12 = 0.005.

Can mortgage interest be deducted?

The mortgage interest deduction is a deduction that allows taxpayers to reduce their income tax bill. The IRS states that you can deduct the interest you pay on your mortgage or home equity loan, but you must itemize deductions on your federal income tax return in order to claim this deduction. The deduction for mortgage interest is not part of the tax computation. It is a deduction on page 2 of the tax form 1040. Mortgage interest is not typically tax-deductible, but rather an itemized deduction that can be subtracted from your income to bring you to your adjusted gross income (AGI). To do this, you must complete Form 1040 (page 2) and Schedule A.

As per IRS , home mortgage interest can not be tax deducted unless the following two conditions are met simultaneously.

- You opt for itemize deductions on Schedule A (Form 1040).

- The mortgage is a secured debt on a qualified home in which you have an ownership interest. The definition of Secured Debt and Qualified Home are provided seprately.

If you like this mortgage payoff extra payment calculator, please share with your friends